The world of fintech has become a competitive place. Back in 2017

Satya Patel, a partner at Homebrew Ventures said:

“We don’t need another fintech app frankly”. Yet dozen of new fintech apps are being launched every month. Some of them manage to become unicorns, others miss the market completely and fail. We took a look at some of the best fintech apps out there trying to understand some of the features both technical and non-technical that made them succeed. All of them have at least 4-star rating in the App Store and Google Play. Although some of the features overlap, we have synthesised the ones that we think made the biggest impression

Revolut

Revolut is one of the fastest growing and well-known fintech companies. What started as an app for money management allowing to send, receive and spend money has grown into one of the leading European mobile banks. For 3 years the company managed to attract 4 million users and reach a valuation of $1.7bln. Mobile lays in the heart of its successful business model. It is considered as one of the best fintech apps. Some of the features that put them ahead of the competition are:

Fast onboarding: The team at Revolut did not only focus on creating cool looking mobile app but one that you could start using as quickly as possible. It is important to remember that 21% of people use an app only once and then abandon it (Localytics, 2018). One of the reasons is the poor onboarding experience. Revolut however, has a fast sign-on process with a minimum need of information that you could complete under 2 minutes. Compare that to the traditional bank where you’d need to fill in lengthy forms to open your account.

Great Visual Language: The design team knows their target customers well: the millennials(people under 40. Colours are fresh and vibrant away from the corporate grey of HSBC for example. Other small touches are the emojis and GIFs in transactions and messages. Although the millennials are tech-savvy: Revolut has also world class UX: the app is easy to navigate and work.

Full control: Customers can decide themselves what level of security they prefer. For example, the user can turn off NFC functionality, block online payments or freeze your card etc. And also unfreeze at any time very easily. This puts the user in control and builds loyalty.

Mint

Mint is one of the forefathers of personal finance management and budgeting apps. It is a classic success story and role model for many.

Security: Lack of consumer trust is one of the biggest problems in front of fintech app adoption. If you want to have access to your user financial information, security should be high on the priority list. Mint protects the sensitive data in a separate database using multi-layered hardware that matches the security standard of banks. All of your data is encrypted with a 256-bit encryption level and the data exchanged with Mint is encrypted with 128-bit SSL. Furthermore, they do a great job explaining to the user on the homepage of their website and in the app that their data is at safe hands.

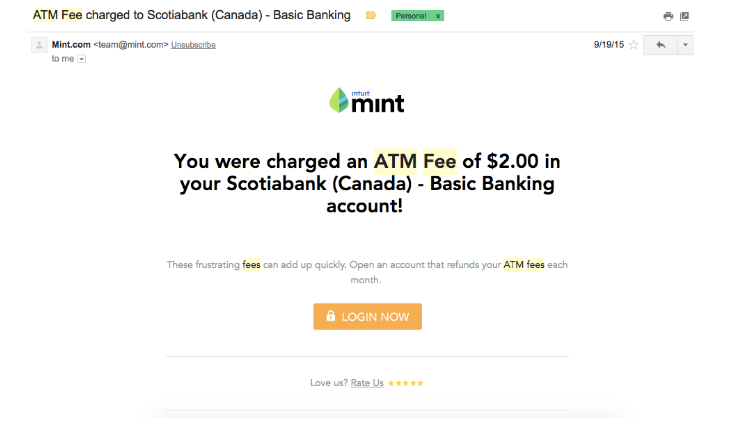

User engagement and retention: There is a high chance that even downloaded your app is going to be used only once. Mint tackles this problem by sending the right messages at the right time with the right content. For instance, events like withdrawing for ATM would trigger a push notification or email to users to inform them. It goes one step further and in the same message offers you information on how to refund your ATM fees. Suddenly as a user you see more value in the product and your loyalty increases. Furthermore Mint also send recurring messages with an overview of how you spend your money.

3.Yulife

YuLife is a kid on the fintech block. Their app offers life insurance plus wellbeing tools for businesses and individuals. Yulife’s aim is to “create lasting, positive lifestyle changes by rewarding simple, everyday activities through insurance and game-based app.

Gamification at its finest: The app uses some of the perks of your phone like pedometer combined with different game challenges to encourage users to collect their unique wellbeing currency called yucoin. The more users do healthy things, like walking the more yucoins they earn to spend in places like Asos, Amazon, Avios etc.

The app uses an underlying human need: the need to play. Gamification is a huge opportunity and still somewhat underestimated by many fintechs as a viable way to increase user engagement. Some behavioural experts claim that we use super successful apps like Uber not only because of the convenience factor but also because it represents a mini-game: seeing how the driver comes to you on the map etc

These are only 3 examples of the best fintech apps out there. When planning your app you could consider some of the features outlined above that could give you a competitive advantage.

If you are a fintech entrepreneur looking for an experienced design and development team: drop us a line

You could also find us on the Eastern Europe Software Development Company directory.